December 2022

Happy New Year! January is a busy time of the year for all of us as we get back into the swing of things. We hope that you were all able to safely enjoy the holidays, even though they looked a little different again this year.

While we continue to work on Annual Reviews and stay on top of the markets/client portfolios, our office is hard at work with many extra tasks in January. This month alone we will manually process and review over 340 RRIF/LIF payment transactions for our clients. This task alone will require 19 hours in the first two full weeks of January to complete. We do this to make sure your payments are made accurately and on time. Along with the RRIF/LIF payments we are also beginning to process TFSA top-ups to ensure your money continues to grow tax free. At the end of January, we will begin to prepare clients’ Capital Gain/Loss reports to ensure you have accurate information to provide your Tax Advisor thus assisting them with your 2022 Tax Reporting, a task that requires over 27 hours to complete.

Around the Office:

We are still working physically here in the office since the start of COVID and are available by telephone. Please feel free to call our office as we would love to hear from you.

With many changes coming forward in the industry, Kristin has been working with our Head Office being proactive in understanding and implementing these changes so that our office is fully aware in advance of what changes to expect. Kristin has also been diligently preparing for the many administrative tasks that come with the first quarter of the new year. RRIF payments are ready to be processed in 2023 and Capital Gain/Loss Reports will be prepared and mailed out by mid-February to those clients on our list. She is also going to set up our team’s processes so clients can contribute to their TFSA and/or RRSP come the 2023 year. As an office, we are largely focused on making 2023 our most productive and efficient year yet to ensure that our clients are serviced in the best way possible. Kristin’s role is vital to ensure all administration runs smoothly so our clients can focus on what is important to them: their hobbies, careers, loved ones etc.

Office COVID Information

Our office continues to rapid test for COVID on a weekly basis. We have also purchased HEPA filters to help with air flow throughout the office. Masking is optional. If you wish for us to wear a mask during your appointment, we will gladly do so.

2023 Tax Changes and New Rules:

Increases to the tax-bracket thresholds and various amounts relating to non-refundable credits take effect on Jan. 1, 2023. But increases for certain benefits, such as the GST/HST credit and Canada Child Benefit, only take effect on July 1, 2023. This coincides with the beginning of the program year for these benefit payments, which are income tested and based on your prior year’s net income, to be reported on your 2022 tax return due this spring.

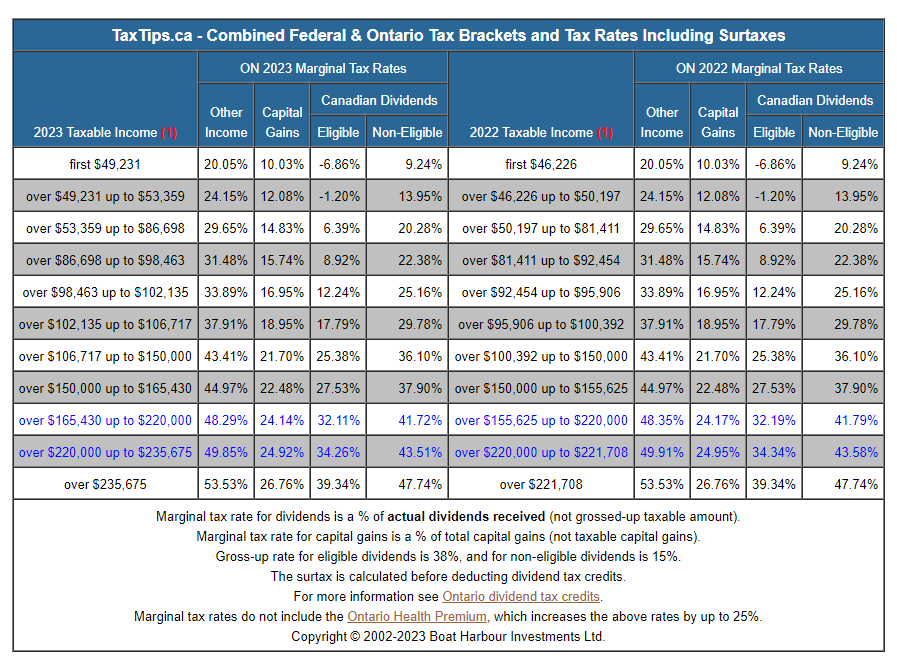

Tax brackets for 2023: All five federal income tax brackets for 2023 have been indexed to inflation using the 6.3-per-cent rate. The new federal brackets are: zero to $53,359 (15 per cent); more than $53,359 to $106,717 (20.5 per cent); more than $106,717 to $165,430 (26 per cent); more than $165,430 to $235,675 (29 per cent); and anything above that is taxed at 33 per cent.

Each province also has its own set of provincial tax brackets, most of which have also been indexed to inflation, but using their respective provincial indexation factors.

Basic personal amount (BPA): The BPA is the amount of income an individual can earn without paying any federal tax. The government in December 2019 announced an increase in the BPA annually until it reaches $15,000 in 2023, after which it will be indexed to inflation. As a result, the increased BPA for 2023 has been set by legislation at $15,000, meaning an individual can earn up to this amount in 2023, before paying any federal income tax.

For taxpayers earning above this amount, the value of the federal credit is calculated by applying the lowest federal personal income tax rate (15 per cent) to the BPA, making it worth $2,250. Because the credit is “non-refundable,” it’s only worth the maximum amount if you would have otherwise paid that much tax in the year.

But higher income earners may not get the full, increased BPA since there is an income test. The enhanced BPA is gradually reduced, on a straight-line basis, for taxpayers with net incomes of more than $165,430 (the bottom of the fourth tax bracket for 2023) until it gets fully phased out when a taxpayer’s income tops $235,675 (the threshold for the top tax bracket in 2023).

Taxpayers in that top bracket who lose the enhanced amount will still get the “old” BPA, indexed to inflation, which is $13,521 for 2023.

CPP (QPP) contributions: The Canada Pension Plan contribution rate for 2023 is 5.95 per cent (6.4 per cent for the Quebec Pension Plan) with maximum contributions by employees and employers set at $3,754.45 ($4,038.40 for QPP) in 2023, based on the new yearly maximum pensionable earnings of $66,600 (with a $3,500 basic exemption.)

For self-employed Canadians who must contribute twice the amount, the maximum CPP contribution for 2023 will be $7,508.90 ($8,076.80 for QPP), up from the 2022 amount of $6,999.60 ($7,552.20 for QPP).

The CPP hike is part of a multi-year plan approved six years ago by the provinces and the federal government to increase contributions and benefits over time.

EI premiums: Employment insurance premiums are also rising, with a contribution rate for employees of 1.63 per cent (1.27 per cent for Quebec) up to a maximum contribution of $1,002.45 ($781.05 for Quebec) on 2023 maximum insurable earnings of $61,500.

Tax-free savings account (TFSA) limit: The 2023 TFSA contribution limit will increase for the first time since 2019 to $6,500 (from $6,000). The cumulative TFSA limit is now $88,000 for someone who has never contributed to a TFSA, and has been a resident of Canada and at least 18 years of age since 2009.

RRSP dollar limit: The registered retirement savings plan dollar limit for 2023 is $30,780, up from $29,210 in 2022. Of course, the amount you can contribute to your RRSP is limited to 18 per cent of your

2022 earned income, which includes (self)employment and rental income, less any pension adjustments, up to the current annual dollar limit.

Old Age Security (OAS): If you receive OAS, the repayment threshold for 2023 is set at $86,912, meaning your OAS will be reduced in 2023 if your taxable income is above this amount.

First Home Savings Accounts (FHSA): Legislation to create the new tax-free FHSA was recently passed, paving the way for it to be launched as early as April 1, 2023. This new registered plan gives prospective first-time homebuyers the ability to save $40,000 on a tax-free basis towards the purchase of a first home in Canada.

Like a RRSP, contributions to an FHSA will be tax deductible, but withdrawals to purchase a first home, including from any investment income or growth earned in the account, will, like a TFSA, be non-taxable. The new legislation confirms that a first-time homebuyer can use both the FHSA and the existing Home Buyers’ Plan to purchase their first home.

Multigenerational Home Renovation Tax Credit: Jan. 1 also marks the beginning of this new credit, which is equal to 15 per cent of eligible expenses (up to $50,000) incurred for a qualifying renovation that creates a secondary dwelling to permit an eligible person (such as a senior or a person with a disability) to live with a relative.

Anti-flipping rules: Finally, new anti-flipping rules for residential real estate are scheduled to come into force on Jan. 1, and are designed to “reduce speculative demand in the marketplace and help to cool excessive price growth.”

The principal residence exemption will not be available on the sale of your home if you’ve owned it for less than 12 months (with certain exceptions). Instead, the gain will be 100-per-cent taxable as business income.

MFDA and IIROC have consolidated in 2023

As of January 1, 2023 the MFDA and IIROC have come together as New Self-Regulatory Organization of Canada (New SRO). The new SRO has assumed the regulatory responsibilities of the MFDA and IIROC.

An interim website for updates and information related to the New SRO including:

- Executive Management

- Governance

- New SRO Rules

- Member Application

- Investor Office and the Investor Advisory Panel

- Information concerning mutual fund dealers registered in Québec

- Complaints

- Careers

https://www.newselfregulatoryorganizationofcanada.ca/

System Updates and Protection of Client Data:

On December 18th, the SickKids hospital suffered a ransomware attack that impacted internal and corporate systems, hospital phone lines, and the website. Ransomware is a form of malware (Malware is any software intentionally designed to cause damage to a computer, server, client, or computer network.) that encrypts a victim's files. The attacker then demands a ransom from the victim to restore access to the data upon payment. Users are shown instructions for how to pay a fee to get the decryption key. The costs can range from a few hundred dollars to thousands, payable to cybercriminals in Bitcoin.

In December 2022, Southwest Airlines, a major U.S. airline, cancelled more than 60% of its flights. Initial investigations cited outdated technology was to blame.

In a statement Wednesday January 11, 2023, the FAA acknowledged that a corrupted file had led to the outage, confirming CNN's reporting. "Our preliminary work has traced the outage to a damaged database file. At this time, there is no evidence of a cyberattack," the FAA said.

In order to try to keep current on such cyber-attacks and every changing technology thus assisting in trying to protect client data and office computer systems, a great investment continues to be made in our office, both in time and money. Firewall protection continues to be updated regularly. Our backup software has been upgraded and continues to be done so on a regular and encrypted basis. Workstation software, Microsoft Office, our security systems and office cameras continue to be updated. As well as an investment into a new office server and updated workstation hardware has been completed and updated regularly. We have completed this to try as best as possible to protect our client data and computers to the best of our ability and avoid any unnecessary downtime.

Annual Reviews

As a reminder, every year we prepare an Annual Review for each of our clients. This is an important process to ensure we are up-to-date with the most current information, as well as ensuring your information is accurate and meeting your Financial Lifestyle needs. Preparing your review involves a detailed process that not only has us look back on the past year but also look at the upcoming year for potential needs that might arise and ensuring client files are up to date and accurate. Spending the time to go over your entire portfolio is even more important given the current situation in the world. A lot has changed for many people, and many things that may have not been thought about before have come to the forefront. To help ease some of your scheduling stress, we are currently booking Annual Reviews via virtual meeting, telephone, or in person, depending on your preference and comfort level. For those doing their Annual Reviews by Zoom/Microsoft Teams or by telephone, the reviews will be uploaded to your Client Portal and/or mailed before the scheduled meeting date.

Our office remains closed to public/walk-ins however, we are available by telephone and in person meeting by appointment only.

For clients requiring an evening appointment, Roman has set aside Monday, Tuesday and Thursday evenings during the next few months to be available. Please be advised that due to the high demand for evening appointments, availability maybe limited.

Reminder - Daily Office Staff Meetings - 9:30am to 10:30am:

Should you call during this period, please leave us a message on our voicemail. We conduct our daily office meeting during this time and phones will not be answered. This time allows us to organize our day’s tasks, review the previous day’s work, discuss and complete client reviews and enquiries, as well as review current rates, markets and updates on the latest news.

Online Deposits/Contributions to your Accounts:

For deposits that you make online throughout the year, please update your Online Banking company name from “HollisWealth Advisory Services Inc.” to “Investia Financial Services Inc” or “Investia Services Financiers”. Do not hesitate to contact us for clarification.

Client Portal, E-Signatures and KYC (Know Your Client) Form:

We hope that you have been able to register and login to your Client Portal and take advantage of its many features. We can securely upload important documents to you through this portal and you can do the same for us. You will have access to certain tax receipts, statements and more dating back to August 2017.

The Electronic Signature process for electronically signing order instructions and updating your Client Information makes things easy to do – even from the comfort of your couch. Should you need assistance in using this form, please do not hesitate to contact us. Please note that our E-Signature documents now come from “Electronic Signature” and not from “E-Sign” as they did previously.

Education:

2022 has been a rollercoaster ride for many reasons: personal, professional and the new world we live in. It has had a profound impact on all of our lives. Through all of these changes and challenges, the two P’s have proven time again to help us through uncertain times and volatility. Patience and perseverance prospered in 2021 over fear and greed that impacted the market and caused unnecessary fluctuations. We as an office have been watching the markets daily with patience and perseverance. We remind our clients of our philosophy of sticking to Strategic Asset Allocation (fancy industry term for don’t put all of your eggs in one basket) and long-term numbers: 1-year, 3-year, 5-year and 10-year. We are confident in our investment choices and that the fund managers we recommend will continue to do their job in providing consistent performance. Let us stress over the day-to-day concerns of the market, COVID, and politics. Enjoy your time on your hobbies, work and most importantly, taking care of your loved ones during these challenging times. 2021’s positive investment results have provided us with a pleasant surprise, especially during a year of uncertainty and doubt due to the challenges we have faced such as inflation, supply chain issues, COVID and more.

Patience is a person's ability to wait something out or endure something tedious, without getting riled up. Having patience means you can remain calm, even when you've been waiting forever or dealing with something painstakingly slow.

Perseverance is persistence in sticking to a plan. Steady persistence in adhering to a course of action, a belief, or a purpose; steadfastness.

Make New Year’s Resolutions That Stick

Are you one of those folks who make New Year’s resolutions, only to give up on them a few weeks later? If so, you’re not alone. A lot of people start the year off with good intentions but find it hard to stick to their goals.

The good news is that it doesn’t have to be that way! With a little bit of vision, planning and effort, you can make New Year’s resolutions that stick. Read on for some tips to help you succeed.

What — Define What You Want to Achieve

Although it can be easy to get lost in the busyness of our everyday lives, setting achievable goals gives us a clear direction and helps us stay motivated. Defining our goals for the next year is a great way to make sure we are making progress towards something worthwhile. Some people may set very specific goals that involve learning new skills or achieving a certain financial milestone. Other people may wish to work on more intangible skills such as improving their confidence, resilience, or creativity. Whatever our unique ambitions and aspirations may be, having them clearly defined means they are more likely to become reality. So, take the time to ask yourself what you want to achieve in the next year and use your answer to guide you on your journey of growth and exploration.

Why – The Goal Is Important to You – The Value it Embraces

Your ‘why’ is the true power behind your progress and secret sauce for your success. Your why reveals a fundamental value that fuels your goals and keeps you motivated, especially when challenges and temptations surface. Take time to explore why this value is so important to you and let this inspire you daily.

How — Create A Plan of Action – How to Get There

Now that your goals are defined and you embrace your why, it’s time to create a plan of action. Break the goal down into smaller, more achievable chunks and then use these chunks as steppingstones for success and celebrations along the journey. This will help you stay focused and motivated throughout the year.

When — Track your progress and Know When

According to the American Psychological Association, those who regularly monitor and track their progress are significantly more likely to achieve their goals. Furthermore, those who publicly reported on their progress increased their success even further. We can use different methods such as tracking apps, journals, planners or reminders to help us stay focused and ensure that we are making improvement.

Having a system in place to track our progress also helps us recognize and celebrate small successes, which can give us the confidence and encouragement to keep going.

Who – Find an Accountability-Partner

You can’t overstate the effectiveness of having an ‘accountability-partner.’ Commit to measurable activities each day or week and call in at pre-set times to be accountable to someone else about your advancement toward your vision, expression of your values, and achievement of your goals. Choose someone who will celebrate your progress and not let you off the hook when it is tempting to go back to old habits. Being held accountable by someone else helps to make sure that we don’t give up when things get tough and reinforces our ‘why.’ This could be a friend, family member or even a professional coach or mentor.

Inevitable Setbacks

Finally, when tackling long-term goals, it is important to remember that setbacks and roadblocks will occur. Don’t let these stop you from achieving what you want—take every setback as a learning experience and use it as motivation to propel yourself forward. Stay focused and determined and success will come in due time.

Celebration

You can make New Year’s resolutions that stick! With a little bit of planning and effort, you can set achievable goals and create a plan of action that will bring you closer to achieving them. Make this year count even more for you —you deserve it!

Good luck on your journey of growth and exploration!

Rhonda Latreille, MBA, CPCA

Founder & CEO

Age-Friendly Business®

Reduce Your Risk of Stroke

Quitting smoking is ranked as one of the top ways you can reclaim better health. The moment you quit smoking, your lungs begin to heal, and within 12 hours your carbon monoxide returns to normal, increasing your oxygen levels. Within 2-5 years, your risk of a stroke is that of a non-smoker.

A New Year

“The New Year is a painting not yet painted; a path not yet stepped on; a wing not yet taken off! Things haven’t happened as yet! Before the clock strikes twelve, remember that you are blessed with the ability to reshape your life!”

Mehmet Murat ildan

“This article is reproduced with permission from Age-Friendly Business, no reproduction in part or in whole is permitted without consent.”

“This newsletter was prepared by Roman A. Groch who is a registered representative of Investia Financial Services Inc. (a member of the Mutual Fund Dealers Association of Canada and the MFDA Investor Protection Corporation). This newsletter is not a publication of Investia Financial Services Inc. and the views and opinions, including any recommendations, expressed in this newsletter are those of Roman A. Groch alone and not those of Investia Financial Services Inc. Investia Financial Services Inc. does not provide income tax preparation services nor does it supervise or review other persons who may provide such services.