March 2023

Spring is officially here! What a nice feeling it is to have daylight last later into the evening! We missed the sunlight during the winter and welcome it back with open arms. Now, we can look forward to warmer temperatures as we venture further into the Spring season.

Around the Office:

Kristin continues to ensure that the administrative tasks of the office are done in a smooth and efficient manner. From daily office coordination to daily/weekly follow-ups, Kristin ensures everything is looked after. She consistently follows up on external transactions to ensure that they are done promptly and correctly. Kristin is also continuously working on contacting clients to schedule in their Annual Reviews, along with preparing these reviews for the scheduled appointments.

Kristin has monthly calls with our contact at Investia’s Head Office to discuss updates to regulations, processes, systems, tools, and more to ensure that we are working as efficiently as we can to keep things simple for our clients and maintaining our high level of client service. In addition, she continues to attend various webinars to stay on top of industry changes and to keep her knowledge up to date.

What is New in 2023 and Federal Budget

Tax-free savings account (TFSA) limit: The 2023 TFSA contribution limit will increase for the first time since 2019 to $6,500 (from $6,000). The cumulative TFSA limit is now $88,000 for someone who has never contributed to a TFSA and has been a resident of Canada and is at least 18 years of age since 2009.

RRSP dollar limit: The registered retirement savings plan dollar limit for 2023 is $30,780, up from $29,210 in 2022. Of course, the amount you can contribute to your RRSP is limited to 18 per cent of your 2022 earned income, which includes (self)employment and rental income, less any pension adjustments, up to the current annual dollar limit.

First Home Savings Accounts (FHSA): Legislation to create the new tax-free FHSA was recently passed, paving the way for it to be launched as early as April 1, 2023. The legislation to enact the FHSA received royal assent on December 15, 2022. This new registered plan gives prospective first-time homebuyers the ability to save $40,000.00, lifetime limit, on a tax-free basis towards the purchase of a first home in Canada with an annual contribution limit of $8,000.00. To open an FHSA, an individual must be a Canadian resident aged at least 18 and not have owned a home during the current year or preceding four calendar years. Regardless of when an eligible person opens a FHSA this year, they will have access to $8,000.00 of contribution room. Unused FHSA contribution room can be carried forward, up to a maximum annual contribution of $16,000.00, but contribution room begins to accrue only after an account has been opened. Anticipate a minimum of 5 years to reach the limit on lifetime contributions of $40,000.00.

Like an RRSP, contributions to an FHSA will be tax deductible, but withdrawals to purchase a first home, including from any investment income or growth earned in the account, will, like a TFSA, be non-taxable. The new legislation confirms that a first-time homebuyer can use both the FHSA and the existing Home Buyers’ Plan to purchase their first home.

Firms are scrambling to set up back-office systems and internal procedures for these complex accounts. That said our recommendation is to wait until this fall before we proceed with these types of accounts. More information to follow as things develop.

Registered Education Savings Plans: When a Registered Education Savings Plan (RESP) beneficiary is enrolled in an eligible post-secondary program, government grants and investment income can be withdrawn from the plan as Educational Assistance Payments (EAPs) in order to assist with post-secondary education-related expenses. EAPs are taxable income for the RESP beneficiary.

The Income Tax Act requires that RESPs place limits on the amount of EAPs that can be withdrawn. For beneficiaries enrolled full-time (i.e., in a program of at least three consecutive weeks’ duration requiring at least 10 hours per week of courses or work in the program), the limit is $5,000.00 in respect of the first 13 consecutive weeks of enrollment in a 12-month period. For beneficiaries enrolled part-time (i.e., in a program of at least three consecutive weeks’ duration requiring at least 12 hours per month of courses in the program), the limit is $2,500.00 per 13-week period.

Budget 2023 proposes to amend the Income Tax Act such that the terms of an RESP may permit EAP withdrawals of up to $8,000.00 in respect of the first 13 consecutive weeks of enrollment for beneficiaries enrolled in full-time programs, and up to $4,000.00 per 13-week period for beneficiaries enrolled in part-time programs.

These changes would come into force on Budget Day. RESP promoters may need to amend the terms of existing plans in order to apply the new EAP withdrawal limits. Individuals who withdrew EAPs prior to Budget Day may be able to withdraw an additional EAP amount, subject to the new limits and the terms of the plan. The Income Tax Act allows for EAPs to be withdrawn up to six months after a beneficiary ceases to be enrolled in an eligible program.

Allowing divorced or separated parents to open joint RESPs.

At present, only spouses or common-law partners can jointly enter into an agreement with a RESP promoter to open an RESP. Parents who opened a joint RESP prior to their divorce or separation can maintain this plan afterwards but are unable to open a new joint RESP with a different promoter.

Budget 2023 proposes to enable divorced or separated parents to open joint RESPs for one or more of their children, or to move an existing joint RESP to another promoter. This change would come into force on Budget Day.

Registered Disability Savings Plans (RDSPs): RDSPs are designed to support the long-term financial security of a beneficiary who is eligible for the disability tax credit. Where the contractual competence of an individual who is 18 years of age or older is in doubt, the RDSP plan holder must be that individual’s guardian or legal representative as recognized under provincial or territorial law. However, establishing a legal representative can be a lengthy and expensive process that can have significant repercussions for individuals. Some provinces and territories have introduced measures that provide sufficient flexibility to address this concern.

A temporary measure, which is legislated to expire on December 31, 2023, allows a qualifying family member, who is a parent, spouse or common-law partner, to open an RDSP and be the plan holder for an adult whose capacity to enter into an RDSP contract is in doubt, and who does not have a legal representative.

Budget 2023 proposes to extend the qualifying family member measure by three years, to December 31, 2026. A qualifying family member who becomes a plan holder before the end of 2026 could remain the plan holder after 2026.

Siblings as qualifying family members

To increase access to RDSPs, Budget 2023 also proposes to broaden the definition of ‘qualifying family member’ to include a brother or sister of the beneficiary who is 18 years of age or older. This will enable a sibling to establish an RDSP for an adult with mental disabilities whose ability to enter into an RDSP contract is in doubt and who does not have a legal representative.

This proposed expansion of the existing qualifying family member definition would apply as of royal assent of the enabling legislation and be in effect until December 31, not>2026. A sibling who becomes a qualifying family member and plan holder before the end of 2026 could remain the plan holder after 2026.

Protecting Canadian from the risks of crypto assets: Budget 2023 announced that the Office of the Superintendent of Financial Institutions (OSFI) will consult federally regulated financial institutions on guidelines for publicly disclosing their exposure to crypto assets. In addition, the government will require federally regulated pension funds to disclose their crypto-asset exposure to OSFI. Simply put, regulation of crypto assets is expanding.

Deduction for tradespeople’s tool expenses: Under the deduction for trades people’s tool expenses, a tradesperson can claim a deduction of up to $500.00 of the amount by which the total cost of eligible new tools acquired in a taxation year, as a condition of employment, exceeds the amount of the Canada employment credit ($1,368.00 in 2023). This amount will double from $500.00 to $1,00.00, effective for 2023 and subsequent taxations year.

Extraordinary tool costs under the apprentice vehicle mechanics’ tool deduction would be those costs that exceed the combined amount of the increased deduction for tradespeople’s tool expenses ($1,000.00) and the Canada employment credit ($1,368.00 in

MFDA and IIROC have consolidated in 2023

As of January 1, 2023 the MFDA and IIROC have come together as New Self-Regulatory Organization of Canada (New SRO). The new SRO has assumed the regulatory responsibilities of the MFDA and IIROC.

An interim website for updates and information related to the New SRO including:

- Executive Management

- Governance

- New SRO Rules

- Member Application

- Investor Office and the Investor Advisory Panel

- Information concerning mutual fund dealers registered in Québec

- Complaints

- Careers

https://www.newselfregulatoryorganizationofcanada.ca/

System Updates and Protection of Client Data

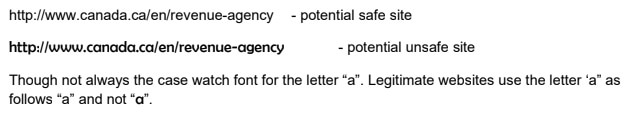

Roman has been asked a few times for tips as to how to identify potential unsafe sites. Here are 2 URL sites; can you spot the difference?

In order to try to keep current on such cyber-attacks and ever-changing technology, thus assisting in trying to protect client data and office computer systems, a great investment continues to be made in our office, both in time and money. Firewall protection continues to be updated regularly. Our backup software has been upgraded and continues to be done so on a regular and encrypted basis. Workstation software, Microsoft Office, our security systems and office cameras continue to be updated. As well as an investment into a new ffice server and updated workstation hardware has been completed and updated regularly. We have completed this to try as best as possible to protect our client data and computers to the best of our ability and avoid any unnecessary downtime.

Annual Reviews

As a reminder, every year we prepare an Annual Review for each of our clients. This is an important process to ensure we are up-to-date with the most current information, as well as ensuring your information is accurate and meeting your Financial Lifestyle needs. Preparing your review involves a detailed process that not only has us look back on the past year but also look at the upcoming year for potential needs that might arise and ensuring client files are up to date and accurate. Spending the time to go over your entire portfolio is even more important given the current situation in the world. A lot has changed for many people, and many things that may have not been thought about before have come to the forefront. To help ease some of your scheduling stress, we are currently booking Annual Reviews via virtual meeting, telephone, or in person, depending on your preference and comfort level. For those doing their Annual Reviews by Zoom/Microsoft Teams or by telephone, the reviews will be uploaded to your Client Portal and/or mailed before the scheduled meeting date.

Our office remains closed to public/walk-ins however, we are available by telephone and in person meeting by appointment only.

For clients requiring an evening appointment, Roman has set aside Monday, Tuesday and Thursday evenings during the next few months to be available. Please be advised that due to the high demand for evening appointments, availability maybe limited.

Reminder - Daily Office Staff Meetings - 9:30am to 10:30am

Should you call during this period, please leave us a message on our voicemail. We conduct our daily office meeting during this time and phones will not be answered. This time allows us to organize our day’s tasks, review the previous day’s work, discuss and complete client reviews and enquiries, as well as review current rates, markets and updates on the latest news.

Client Portal, E-Signatures and KYC (Know Your Client) Form

We hope that you have been able to register and login to your Client Portal and take advantage of its many features. We can securely upload important documents to you through this portal and you can do the same for us. You will have access to certain tax receipts, statements and more dating back to August 2017.

The Electronic Signature process for electronically signing order instructions and updating your Client Information makes things easy to do – even from the comfort of your couch. Should you need assistance in using this form, please do not hesitate to contact us. Please note that our E-Signature documents now come from “Electronic Signature” and not from “E-Sign” as they did previously.

March 2023 Quarterly Statement

2023 has thus far been a much more positive year to date as you will note with your enclosed statement dated March 31, 2023 unlike the 2022 year. We as an office have been watching the markets daily with patience and perseverance. We remind our clients of our philosophy of sticking to Strategic Asset Allocation (fancy industry term for don’t put all of your eggs in one basket) and long-term numbers: 1-year, 3-year, 5-year and 10-year. We are confident in our investment choices and that the fund managers we recommend will continue to do their job in providing consistent performance. Let us stress over the day-to-day concerns of the market, COVID, and politics. Enjoy your time on your hobbies, work, and most importantly, taking care of your loved ones.

As a reminder to all of us, though easier said than done:

Patience is a person's ability to wait something out or endure something tedious, without getting riled up. Having patience means you can remain calm, even when you've been waiting forever or dealing with something painstakingly slow.

Perseverance is persistence in sticking to a plan. Steady persistence in adhering to a course of action, a belief, or a purpose; steadfastness.

Building a Legacy That Goes Beyond Material Wealth

Have you ever wondered what lasting legacy you will leave behind for future generations? While accumulating material wealth can be significant, passing on values and characteristics that will stand the test of time is essential. Doing this allows us to create a foundation that encourages growth and advances our family’s mission well into the future; something investments alone cannot always provide. This article will discuss how you can build a legacy beyond material wealth by embracing character, ethics, beliefs, culture, core values and more. Read on as we explore ways in which you can ensure your legacy reaches far beyond your assets.

Years ago, I had the privilege of hearing Lee Brower speak about the various assets we can pass on to the next generations. Lee served as a financial advisor to ultra-high net worth families and recognized that material wealth would not survive as a long-term legacy without the gifts of character, education, reputation, and service. This approach is not exclusive to wealthy families and offers excellent opportunities for everyone interested in defining what legacy really means to them.

It all starts with ‘BEING.’

Ralph Waldo Emerson is credited with the famous quote: “Who you are speaks so loudly I can’t hear what you are saying.” Directly facing me, on the wall in my office, is a post-it note asking me, “Who do I want to be in the face of this?” Provocative question. When I remember (!) to look at the post-it note and reflect on the challenge, I have the opportunity to consider first my ‘being’ rather than ‘doing.’ I suspect this is what Lee Brower and Emerson inspired us to consider because an explicit declaration of whom we want to be absolutely informs what we do at that moment.

Think about how you want your children and grandchildren to show up in this world. Whom do you want them to be in their quiet moments alone and times of reflection? What values and character traits do you prefer to inform and guide their actions? What is the image of ‘who’ you want them to be regarding how they serve their family, friends, local and global community as well as themselves? What education, skills, resources and supports must be in place to contribute to this vision?

Actions Speak Louder Than Words

You don’t have to be Mother Teresa or Mahatma Gandhi. It can be as simple as living the life you want to demonstrate to your loved ones. This inspires, educates, and shapes the lives of those who look up to you.

I belong to a small Rotary Club in my community. In this club is a husband-and-wife team who exemplify the Rotary motto of ‘service above self.’ They are involved in every fundraising event and provide direct service to both local and international projects. They are the first to call a local member who has been absent and offer rides to social and service events to ensure everyone is included. Their adult children assume leadership roles in their careers, children’s school, sports, and community events. Their grandchildren help to put up posters, stuff envelopes, volunteer at service projects, and even host lemonade stands to raise money for children at a residential home in Cambodia. All this without fanfare and lecture – just the powerful impact of demonstrating life lessons to navigate young growth, parenthood, professional careers and community service. Their legacy is a living example of enduring throughout multiple generations! By example, the next generations are “living the values.”

Conclusion

Leaving a lasting legacy involves more than just passing down wealth to future generations; it is about infusing moral values and practical wisdom into succeeding lineages to cultivate a responsible and enriching life. Families can adopt several strategies for imparting valuable lessons and knowledge beyond monetary inheritances. Parents and grandparents can initiate open discussions regarding their life experiences, challenges they overcame and critical choices, fostering a culture of storytelling that intertwines personal philosophy with knowledge. Moreover, investing in one’s children’s education and supporting their pursuit of personal growth can instill a deep appreciation for continuing expertise and exploration. Encouraging children to engage in charitable and community service activities cultivates empathy and fosters a sense of social responsibility, further enriching their lives. Setting clear expectations about work ethics, financial prudence, and integrity also instills invaluable virtues that empower future generations to make responsible decisions and apply the wisdom gained in various life aspects. Ultimately, nurturing and bequeathing virtues transcend monetary wealth and create a lasting family legacy that endures over time.

Rhonda Latreille, MBA, CPCA

Founder & CEO

Age-Friendly Business®

Service and Your Health:

Studies have found that engaging in acts of service and kindness is linked to physiological benefits such as higher levels of oxytocin, serotonin and endorphins, which can lead to improved mental well-being and decreased levels of stress (Zaki & Ochsner, 2009; Post, 2007). Additionally, volunteering activities have been associated with better cardiovascular functioning (Wang et al., 2013).

A Life of Service

“Everybody can be great because everybody can serve.”

Martin Luther King, Jr.

“This article is reproduced with permission from Age-Friendly Business, no reproduction in part or in whole is permitted without consent.”

“This newsletter was prepared by Roman A. Groch who is a registered representative of Investia Financial Services Inc. (a member of the Mutual Fund Dealers Association of Canada and the MFDA Investor Protection Corporation). This newsletter is not a publication of Investia Financial Services Inc. and the views and opinions, including any recommendations, expressed in this newsletter are those of Roman A. Groch alone and not those of Investia Financial Services Inc. Investia Financial Services Inc. does not provide income tax preparation services nor does it supervise or review other persons who may provide such services.