September 2023

As the season turns to milder temperatures, we hope that you all had an enjoyable summer with lots of time spent outside and many memories made.

Around the Office:

Kristin continues to work with our Head Office regularly to keep up on new initiatives to simplify our processes, and to keep abreast of any changes whether they be regulatory, administrative or client-focused.

Kristin is here to assist with client administrative needs, including, but not limited to, Client Portal issues, clarification on notices received from Investia, scheduling meetings / phone calls with Roman, year end tax slips and general account inquiries just to name a few.

With her favourite season now here, Kristin is looking forward to all things Autumn! Enjoying fall festivals, fairs, pumpkin patches, fall colours & drinking apple cider with her family.

Declan is an active golfer during the summer and enjoys working on cars. During the winter, he enjoys snowboarding when free time is available. He always enjoys staying busy and enjoys finding various projects of all sorts to keep busy and continue learning.

Declan is relatively new to the area as he just moved to Welland last September from where he grew up in Norfolk County. Declan can be reached at our office number 905-735-5555 or directly by email .

I worked fourteen games in total and got to work some big games. I was behind the plate for USA vs. Chinese Taipei. This was a battle of first place teams from their pools. As well, I was the first Canadian to be selected to call balls and strikes in the gold medal game for a men’s world championship. The final was 2-1 for Japan over Chinese Taipei. I’ve umpired in front of 35,000 people but for this game there were 11,000 fans and it was the loudest experience I’ve ever had on a baseball field. The local TV broadcast had me testing out something they called “Umpire Cam”, which was essentially just a go pro on the top of my mask. It was very uncomfortable but apparently, they got some great video.

I made sure to get out to the local night markets to see the sights and try the cuisine. I’m a big fan of their fried chicken and I love Cantonese Dim Sum. What an amazing experience, but after two weeks away, I was happy to get home to family and back to work. Here are a couple of pictures below.

Reminder - Daily Office Staff Meetings - 9:30am to 10:30am

Should you call during this period, please leave us a message on our voicemail. We conduct our daily office meeting during this time and phones will not be answered. This time allows us to organize our day’s tasks, review the previous day’s work, discuss and complete client reviews and enquiries, as well as review current rates, markets and updates on the latest news.

Annual Reviews

As a reminder, every year we prepare an Annual Review for each of our clients. This is an important process to ensure we are up-to-date with the most current information, as well as ensuring your information is accurate and meeting your Financial Lifestyle needs. Preparing your review involves a detailed process that not only has us look back on the past year but also look at the upcoming year for potential needs that might arise and ensuring client files are up to date and accurate. Spending the time to go over your entire portfolio is even more important given the current situation in the world. A lot has changed for many people, and many things that may have not been thought about before have come to the forefront. To help ease some of your scheduling stress, we are currently booking Annual Reviews via virtual meeting, telephone, or in person, depending on your preference and comfort level. For those doing their Annual Reviews by Zoom/Microsoft Teams or by telephone, the reviews will be uploaded to your Client Portal and/or mailed before the scheduled meeting date.

Our office remains closed to public/walk-ins, however, we are available by telephone and in-person meetings by appointment only.

If you would like for us to wear a face covering for your in-person meeting, please notify our office before your scheduled meeting, and we will be more than happy to do so.

For clients requiring an evening appointment, some evenings have been set aside to accommodate. Please be advised that due to the high demand for evening appointments, availability maybe limited.

System Updates and Protection of Client Data

Our office continues to invest heavily in systems to protect your data. To protect your digital information, we use a VPN, firewall, and various other encryption methods. We also protect the physical premises by keeping the office locked at all times, keeping physical files locked up overnight and as well as an alarm system and multiple high-definition cameras throughout the building. We take your privacy very seriously, but as time moves on, it may never be 100% in protecting your data. Sometimes even the most secure data can be exposed.

Since our June 2023 letter we “Googled” recent ransomware attacks in Canada and most will be surprised. CardioComm July 25, 2023, Yamaha Canada Music July 11, 2023, Alberta Dental Service Corporation July 09, 2023, Suncor June 23, 2023, University of Waterloo May 30, 2023, Constellation Software May 04, 2023, The City of Toronto March 23, 2023, Yellow Pages Canada March 15, 2023, Indigo February 08, 2023, Sobeys November 07, 2022, Bell Canada August 08, 2022… This is just to name a few.. Let us not forget GoAnywhere February 08, 2023.

Source: https://spin.ai/resources/ransomware-tracker/

Steps One Can Take to Deter Ransomware

Many clients are already aware of the fact Roman likes his IT Technology and gadgets. One question asked of him lately is “what can I do to prevent getting Ransomware?”. Well, the bad news is that eventually most of us will be “hacked”. That said, there are measures we can take to deter but most importantly restore our compromised computers. Two such measures are purchasing/subscribing to Antivirus and Backup software for starters. For Antivirus, Roman recommends Norton 360 Deluxe which protects up to 5 computers, though other Antivirus software does exist Roman has personally used this one. As to Backup software, the purpose of this is when your computer gets compromised you can restore your computer and data to a previous date prior to your computer being compromised and risk only losing some data. Acronis Cyber Protect Home Office is software Roman has used. Remember to set the backup software to back up your computer daily, encrypt your backup and store on an external hard drive, or better yet, the CLOUD. Other measures include using a “true” VPN (Virtual Private Network) as well a firewall such as Watchguard or Netgate to name a few.

Client Portal, E-Signatures and KYC (Know Your Client) Form

If you haven’t done so yet, we encourage you to set up your “Client Portal” and take advantage of its many features. We can securely upload important documents to you through this portal and you can do the same for us. You will have access to certain tax receipts, statements and more. You can also make changes to your personal information, such as, email address, home address, phone number, and bank account without having to come into the office to sign off on paperwork.

The Electronic Signature process for electronically signing order instructions and updating your Client Information makes things easy to do – even from the comfort of your couch. Should you need assistance in using this form, please do not hesitate to contact us. Please note that our E-Signature documents now come from “Electronic Signature” and not from “E-Sign” as they did previously.

Education

Throughout the Fall season, Roman will be attending several conferences where he will have a chance to meet and interact with several Portfolio Managers, Economists, and Compliance experts. He will be able to get the inside scoop and a better understanding of recent developments, markets, taxation and compliance. This is to ensure he is up to date and aware of recent developments within the financial markets and the industry itself. Roman has committed not only his time but also financially. These conferences are paid directly by Roman with regards to transportation (airline tickets and accommodations) – an investment for our clients. These are in-person conferences which helps ensure that the advice he is giving is current. He also wants to ensure that the advice is not a page out of some article or report but directly from the Portfolio Managers themselves. This gives him an opportunity to interact in person with most of the managers that he recommends. Pictured to the left is Roman with Konstantin Boehmer, MBA. SVP, Co-Lead of Fixed Income Team, Head of Global Macro, Portfolio Manager Responsible for active management of $60 billion of global fixed income assets using fundamental and quantitative/technical strategies. Roman had the opportunity to sit down with Konstantin one-on-one for 15 minutes to personally ask and hear his insight. It was interesting to hear from the Portfolio Manager himself and the proactive measures he is taking with his bond portfolio especially with the recent news of higher rates for longer, thus causing significant bond trading the last weeks of September into October. One such measure being selling off long term bonds for shorter duration bonds to take advantage of the recent higher yield (interest) rates.

During the week of October 3rd, Roman attended the Investia Financial Services Due Diligence Conference in Toronto. Here, he was able to interact with Compliance, Head Office personnel and other Advisors to share stories to better serve our clients. As well, he met friend and mentor Daryl Diamond, author of Your Retirement Income Blueprint. Daryl is an author and educator on the subject of using your assets to realize the greatest amount of security and satisfaction during the retirement years. He is well-known among his peers as one of the first financial advisors in Canada to identify the special skills and knowledge required to effectively and efficiently address the needs of the retirement income market. During the week of Week of October 10th Roman will be attending the Fidelity Due Diligence Conference in West Palm Beach, FL.

In November, Roman will be taking some personal time off to spend with friends and family.

In addition to attending several webinars to further their knowledge of various topics (beyond finances) that come up during reviews with clients, Kristin and Declan will be attending the Investia Administrative Conference. They will see what our Head Office is doing to assist administrators to ensure that we are able to provide outstanding service to our clients. They will be getting updates on technology, processes, security, compliance and more.

Responsible Investing

It’s all the craze, or so they say. ESG (Environmental, Social, Governance), SRI (Socially Responsible Investing), CSR (Corporate Social Responsibility), Sustainable Investing, Carbon Neutral, Green and Impact Investing. These are just a few of the things that you’ve perhaps seen written about what can often be summed up as “responsible investing.’ What does it all actually mean though?

As we push for a better world, what’s important to people is evolving. And that has also meant that many people are thinking more about how they invest and whether it aligns with their values. Keith holds the Responsible Investment Specialist designation, so we can help make sense of it all.

There are many investment funds available on the market today that have responsible investing mandates. They use a mix of negative screening as well as positive screening to include companies in certain economic sectors. This means they will not invest in nuclear, tobacco, gambling, alcohol, or weapons manufacturing. Some funds will then go on to invest in only green energy sources or companies that have a history of great governance or companies that have a zero net carbon footprint. In the end, the goal of these funds is to produce an acceptable return, while reducing the risk that may come from specific industries or companies that are not following best practices. They will appeal to some investors’ social values and we see many companies moving toward sustainability in their businesses. (Think Philip Morris)

As these strategies have gone mainstream, and large corporations incorporate more ESG in their businesses, many conventional mutual fund portfolio managers are also employing some of these strategies as part of their mandate.

September 2023 Quarterly Statement

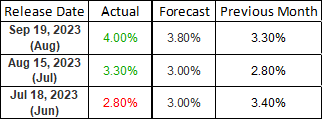

Inflation, Inflation, Inflation. In case you haven’t heard that word enough in the last couple of years, it continues to be the recurring theme. As you can see by the chart below, inflation numbers have gone up the last couple of months, when the goal was to have them go down.

Why is this? The three biggest contributors appear to be rising gas prices, food costs and housing costs. In June we saw a reduction in global supply of crude oil and this saw a corresponding price increase. Food inflation has slowed, but is still contributing negatively to our cost of living. Supply chain, tariffs and energy costs are major contributors. As the Bank of Canada has increased rates so rapidly over the last couple of years, mortgage interest rates have followed. And higher rates are making inflation stickier. It’s a catch 22 as increased interest rates are intended to slow down spending; not increase it.

So, what does this mean for your money? Although, the TSX is up around 1% for the year and the S&P 500 is up double digits, the third quarter of 2023 has seen both the S&P 500 and the TSX pull back slightly. Bond yields appear to be on the rise as well, aided by higher rates and a pause in increases by the Bank of Canada.

We understand that volatility in the markets can be hard to watch. Sticking to a Strategic Asset Allocation (diversification) is how we help shelter your portfolio from many types of risk. Time invested is far more reliable strategy than timing the market, which means that we look to balance your immediate needs with those of the future. Let us stress over the day-to-day concerns of the market, and politics. Enjoy your time on your hobbies, work, and most importantly, taking care of your loved ones.

As a reminder, Patience & Perseverance have proven time and time again with our office to help us through uncertain times and volatility. Our philosophy, as an office, remains – it is far more difficult to be unique than it is to follow the crowd, and doing what is right is not always following the crowd.

Patience is a person's ability to wait something out or endure something tedious, without getting riled up. Having patience means you can remain calm, even when you've been waiting forever or dealing with something painstakingly slow.

Perseverance is persistence in sticking to a plan. Steady persistence in adhering to a course of action, a belief, or a purpose; steadfastness.

AI and Older Workers: Resisting, Navigating, or Embracing the Wave of Digital Transformation

Gone are the days when the digital revolution was merely a plotline in science fiction movies. It is now our reality. This transformative wave brings both excitement and trepidation, particularly among older generations. The fear of being left behind in a technology-driven world is real and haunting. Will there be a place for all of us in this emerging landscape?

The Hurdles Encountered by Seasoned Workers

The concerns and their corresponding obstacles are not unfounded. The barriers for older workers encompass a broad spectrum, including feelings of digital insecurity, battling against external and internalized stereotypes and ageism, limited access to training programs, and navigating evolving workplace dynamics. Dr. Sajia Ferdous’ illuminating research sheds light on these challenges, emphasizing the sense of displacement experienced by older workers in tech-saturated environments.

The Indispensable Contributions of Older Workers

On the other hand, could it be that older workers hold a distinct leg-up in this advancing digital landscape? Jacob Zinkula, in his enlightening article, “Older generations have an advantage in the AI boom: people skills and experience that can’t be automated away,” contends that the older generations possess a wealth of people skills, profound experience, and the art of mentorship. These attributes, refined over years of personal and professional experiences, cannot be coded or automated, making them a unique asset in any organization. (Although, it should be noted that Hitachi is using AI to learn from and capture the qualitative expertise of experienced workers!)

Fostering a Collaborative Future

In this quickly evolving scenario, do we need to choose between AI and experience, or can we embrace and recognize the harmony they can create together? Could AI automate our more mundane tasks, freeing up staff to engage in higher levels of planning, employee and customer engagement? The efficiency driven by AI can gracefully intertwine with the rhythm of age-old wisdom, resulting in a harmonious and thriving work environment. Our challenge, and indeed our greatest opportunity, lies in leveraging the strengths of both AI and our senior workforce, and forging pathways that celebrate and value the uniqueness of each.

Guiding Principles for a Brighter Tomorrow:

As we have discovered in other newsletters, merely throwing people and concepts together is not a successful strategy for change or transformation. Collaboration and integration must be thoughtful, intentional, and strategic. Below are some suggestions that contribute to a more rewarding incorporation of time-tested wisdom and experience with the promise and efficiencies of new technologies:

- Develop tailor-made training programs that cater to the different learning curves of older employees, helping them familiarize themselves with AI.

- Establish mentorship programs where seasoned workers and AI experts collaborate, ensuring knowledge flows both ways.

- Highlight the irreplaceable human touch that older workers bring, which AI cannot replicate.

- Foster an Age-Friendly Business® environment where everyone, regardless of their age, feels empowered and valued.

In Conclusion

In this intricate dance of technology and humanity, let’s lead with empathy, understanding, and a vision for a workplace that values both the depth of experience and the boundless possibilities of AI. Let’s stay inspired, remain adaptable, and always champion the blend of heart and innovation. Together, we can craft a future where wisdom and innovation seamlessly intertwine, creating a tapestry that reflects the richness of our collective journey.

Rhonda Latreille, MBA, CPCA

Founder & CEO

Age-Friendly Business®

Better Body and Better Health Through AI

Discover the vast potential of AI in revolutionizing our physical health. From early disease detection to personalized treatment plans and robot-assisted surgeries, AI is reshaping healthcare. Stay proactive with wearable devices equipped with AI algorithms that monitor real-time health data. Experience the convenience of AI-powered virtual health assistants that offer instant responses, schedule appointments, and send medication reminders. Bridge the healthcare gap between rural and urban areas with AI-driven telemedicine platforms. Embrace the digital age and make AI integration a necessity for a healthier and stronger future

Courage and Change

This article is reproduced with permission from Age-Friendly Business, no reproduction in part or in whole is permitted without consent.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed, and produced by Roman A. Groch and Keith McConkey, for the benefit of Roman A. Groch and Keith McConkey, Mutual Fund Representatives with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities. Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Fund Fact sheet or prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.